Drive Investment Decisions with Conviction

Alersal™ is a position management platform that identifies market shifts before the price action and enables one-click order placements. By uncovering shifts and reversals earlier than traditional methods, Alersal™ eliminates decision-making delays, enables proactive positioning, and helps our clients outperform benchmarks. The precision of the platform analytics inspires confidence in taking risks and staying the course, even when the market takes unexpected turns.

Unmatched Market Analysis

Take Risks With Analysis Backed By Data Science

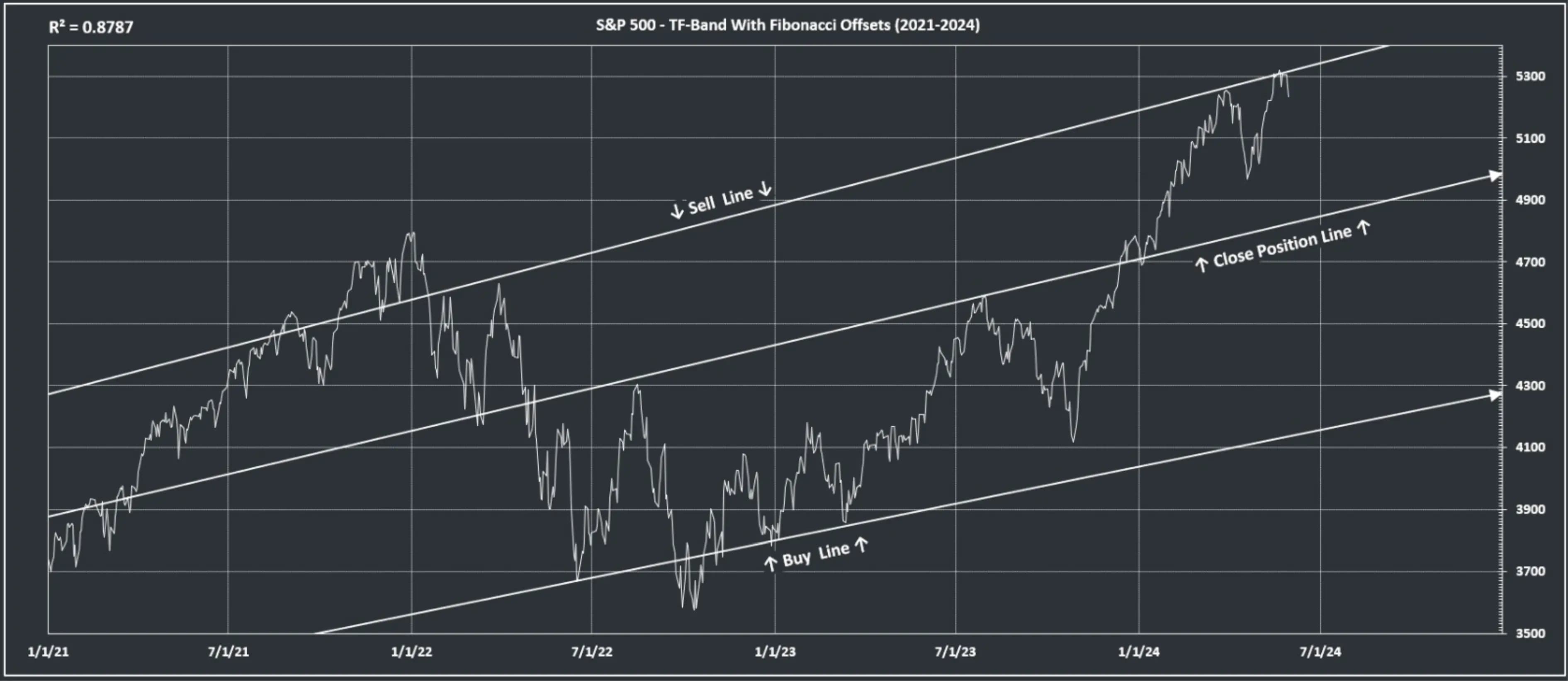

Alersal™ engine is built on top of statistical regression and a mathematical series that models market volatility. It guides investors into action by triggering SMS/Text alerts well before a reversal event occurs, improving their bottom-line to:

Lock in additional gains by accelerating trade decisions that were waiting for price action confirmation. In other words, Alersal™ can lead to incremental rewards without taking incremental risk.

Systematically capture option premiums by selling options beyond the trading range demarked by reversal points. In other words, Alersal™ can lead to enhanced portfolio performance, i.e., better alpha.

Determine portfolio impact by placing a paper order before broker execution. In other words, Alersal™ can perform what-if analysis to spell out strategy performance before capital is committed.

Our Commitment To You

Comprehensive Support

Our team is always ready to offer full support, ensuring you have the guidance and assistance you need every step of the way.

Expert Analysis

Receive reliable signals derived from the expert analysis of our experienced trading professionals. Alersal prides itself on delivering actionable insights that are both timely and precise.